How is the London Market adapting to and using AI to support the Claims Function?

How is AI being used in Claims?

1. Efficiency: Streamlining the Claims Process

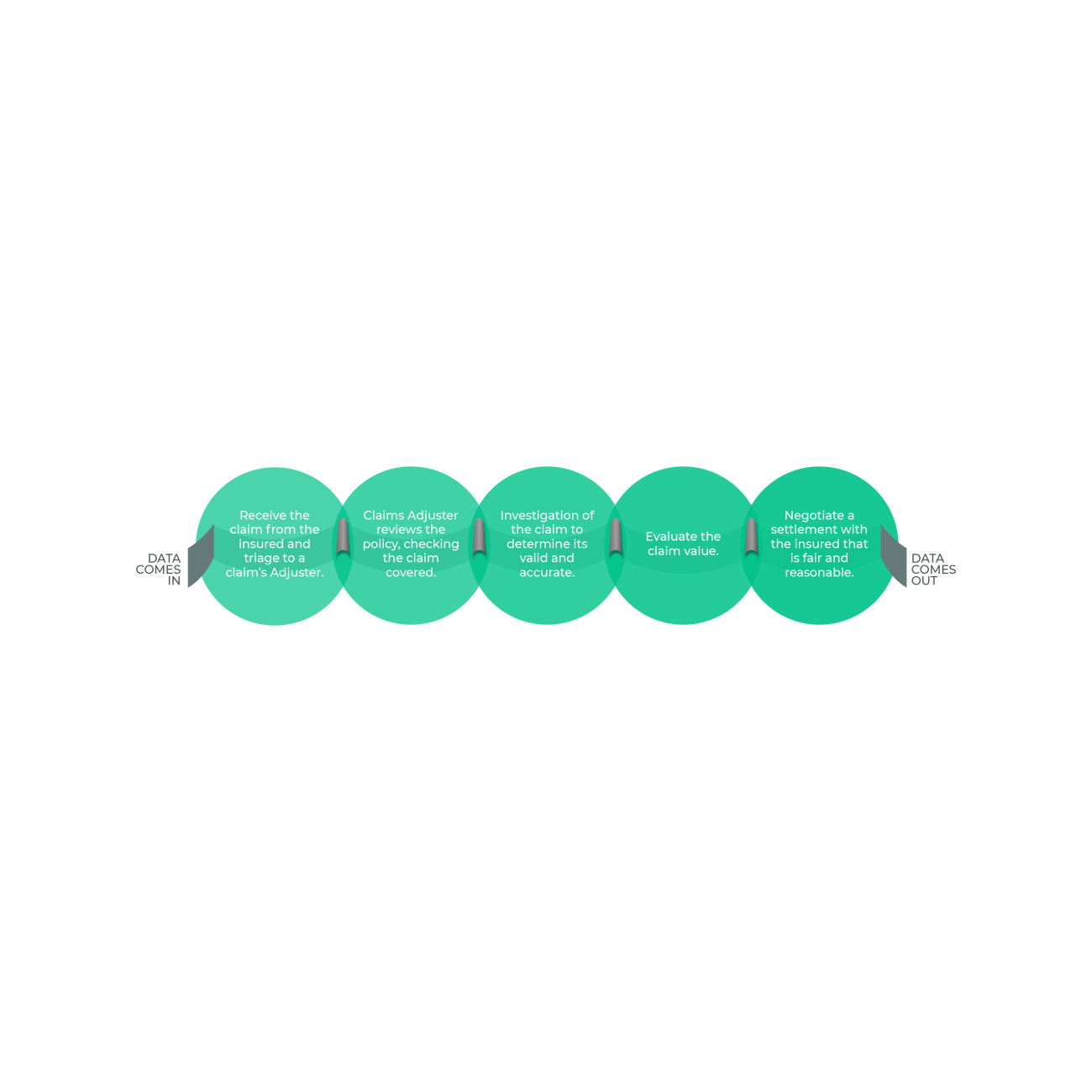

Handing a claim from the First Notification of Loss (FNOL) all the way to insights and analytics (Claims Management Information (MI)), can be supported by AI.

Traditionally, claims processing has been highly manual, with many administrative steps — reading and sorting documents, checking information, data rekeying and assessing damages and associated to a process that as a result is slow with high operational costs. AI can now automate these tasks, reducing the claims processing time from weeks or months to just a few hours or even minutes

For example, AI is now being used to extract data from unstructured documents, such as loss reports, and cross-reference this data with policy documents. Coupled with Robotic Process Automation (RPA) or an Application Programming Interface (API), this same data can then be pushed into downstream claims systems which eliminates the need for data rekeying.

As repetitive tasks are automated and rekeying reduced, the claims adjusters can focus on more complex adjusting cases that require human skills such as negotiation.

Alchemy London Market is already seeing a significant improvement in efficiency of claims processing, particularly for high-volume, lower complexity claims.

2. Effectiveness: Speed

One of the key metrics to assess a claims function is speed, as highlighted in the market-wide Gracechurch Street Claims survey.

AI enables a far speedier and accurate claims process because the AI’s ability to process data quickly and automate tasks allowing claims handlers to provide real-time updates and faster claim resolutions.

3. Accuracy: Data Clean-up

One of the big limiting factors to effective claims analytics and the effectiveness of the policy is claims causation. Where data entry has been manual, claims systems are littered with ‘unknown’, ‘other’ or simply ‘fire’.

AI can now ‘read’ and extract complex data points and classify them to a structured data model across a large corpus of documents and then clean-up historic data going back as far as the organisation has claims files.

This is a true game-changer to enable claims analysis, and ultimately better pricing. Insurers can also use this data to provide risk management advice back to the insured.

4. Insight: Enhancing Decision-Making with Predictive Analytics

AI can analyse vast amounts of data in real-time which is proving invaluable in improving the quality and consistency of decision-making in claims handling. Claims decisions supported by AI smooth out the human biases and experience levels where different adjusters might make different decisions. This enhances accuracy and means that claims can be settled with a lower level of human intervention.

Insurers are utilising predictive analytics to assess the claim and make more informed decisions on whether to approve, reject, or investigate claims based on historic data patterns. AI can predict which claims are likely to escalate into litigation, helping claims handlers make proactive decisions, such as early settlement offers, to mitigate potential legal costs. Claims handling is becoming a forward-looking, strategic function.

5. Complex Claims

The London Market has a high level of human expertise and knowledge to be able to deal with complex claims. Here too, AI can help evaluate massive datasets that include weather reports, satellite imagery, and Internet of Things (IoT) sensor data to assess damage faster and more accurately and to allocate resources for repair or replacement more effectively.

AI is also proving useful in managing claims litigation. By analysing legal documents, precedents, and jurisdictional trends, AI can help insurers anticipate the outcome of legal disputes so that they can tailor their claims strategies.

Ethical and Regulatory Considerations

Whilst the benefits are clear, there is a need for caution. While the benefits of AI in claims processing are clear, its use does raise some ethical and regulatory concerns, particularly around transparency and fairness. Recently, JEL Consulting Limited created a Code of Conduct for the use of AI in Claims. A key now market initiative which has been developed to use AI safely and securely.

The Future of AI in Claims Handling

As AI continues to evolve, its impact on claims handling will also evolve. What is clear is that those insurers that embrace AI will outperform those that do not because of improved operational efficiency and the ability to make faster, more informed decisions.