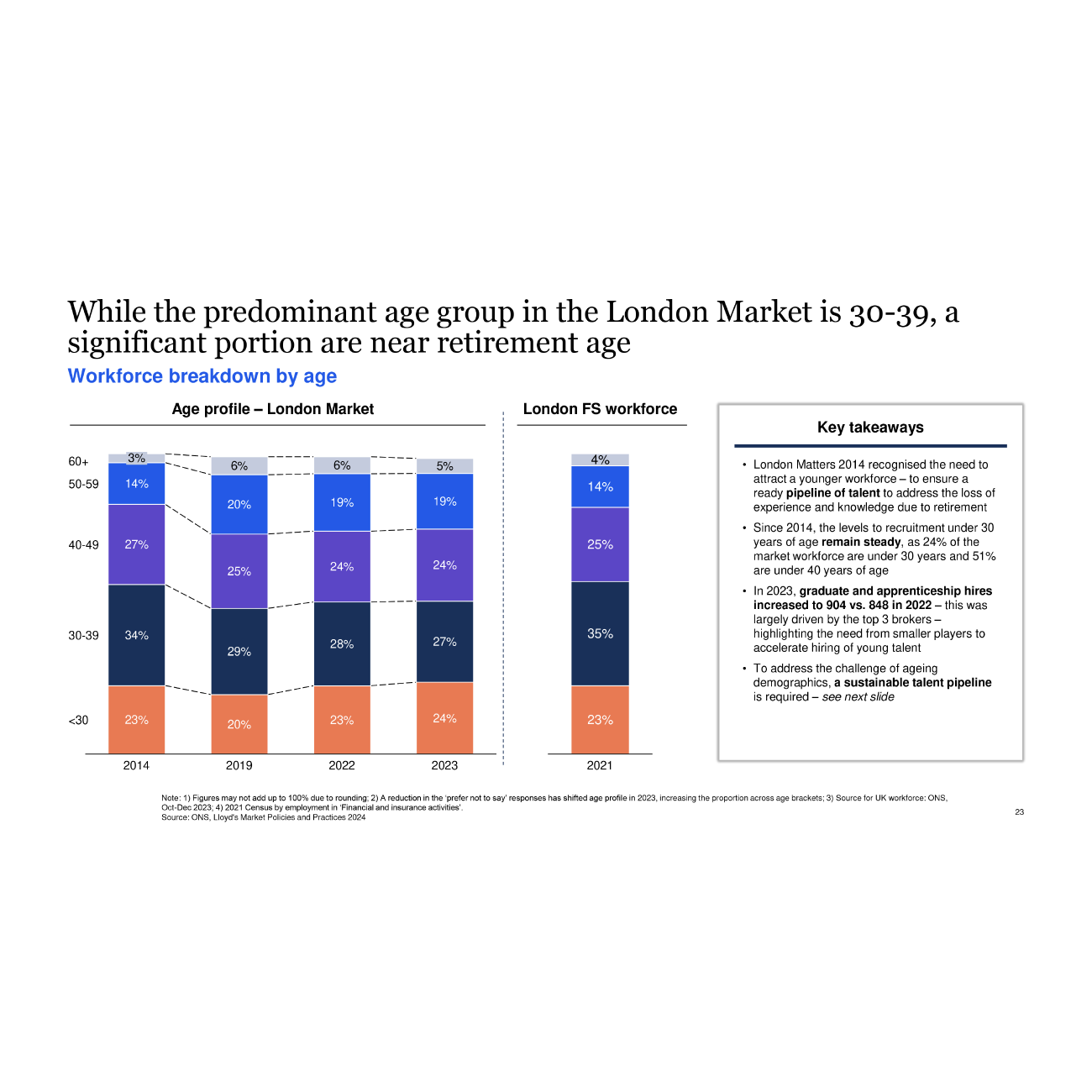

This is being caused by both a generation of experienced claims handlers and adjusters retiring and insufficient numbers of young talent entering the industry. While this loss of expertise is in part being solved for by AI and automation, the very introduction of new technology and consequent data insights is causing its own issues.

The increased use of data and technology means that roles are being reshaped with new skills required as well as maintaining the need for human skills such as negotiation, relationship building and guiding claimants during a time of high stress post loss.

1. The Shifting Skill Sets in Claims Handling

Whereas once, claims handling required skills such as:

- Deep understanding of policy wordings & legal reports / legal education

- The ability to assess and process complex claims data (structured and unstructured)

- Empathy & sympathy and

- strong negotiation skills

With the rise of AI and data analytics, much of the work can now be done by AI.

AI can ‘read’ and process multiple complex unstructured documents and provide an initial opinion on whether the claim is covered, an estimate of the quantum of the claim, and its propensity to head towards litigation. Data entry can also be automated, and AI is increasingly being used to triage claims, detect fraud, and streamline communications via automated emails.

What is a claims handler left to do? Now, the claims handler also needs:

- to be data literate

- have the ability to interpret and understand (to a degree) AI-driven insights to be able to spot delusions and biases

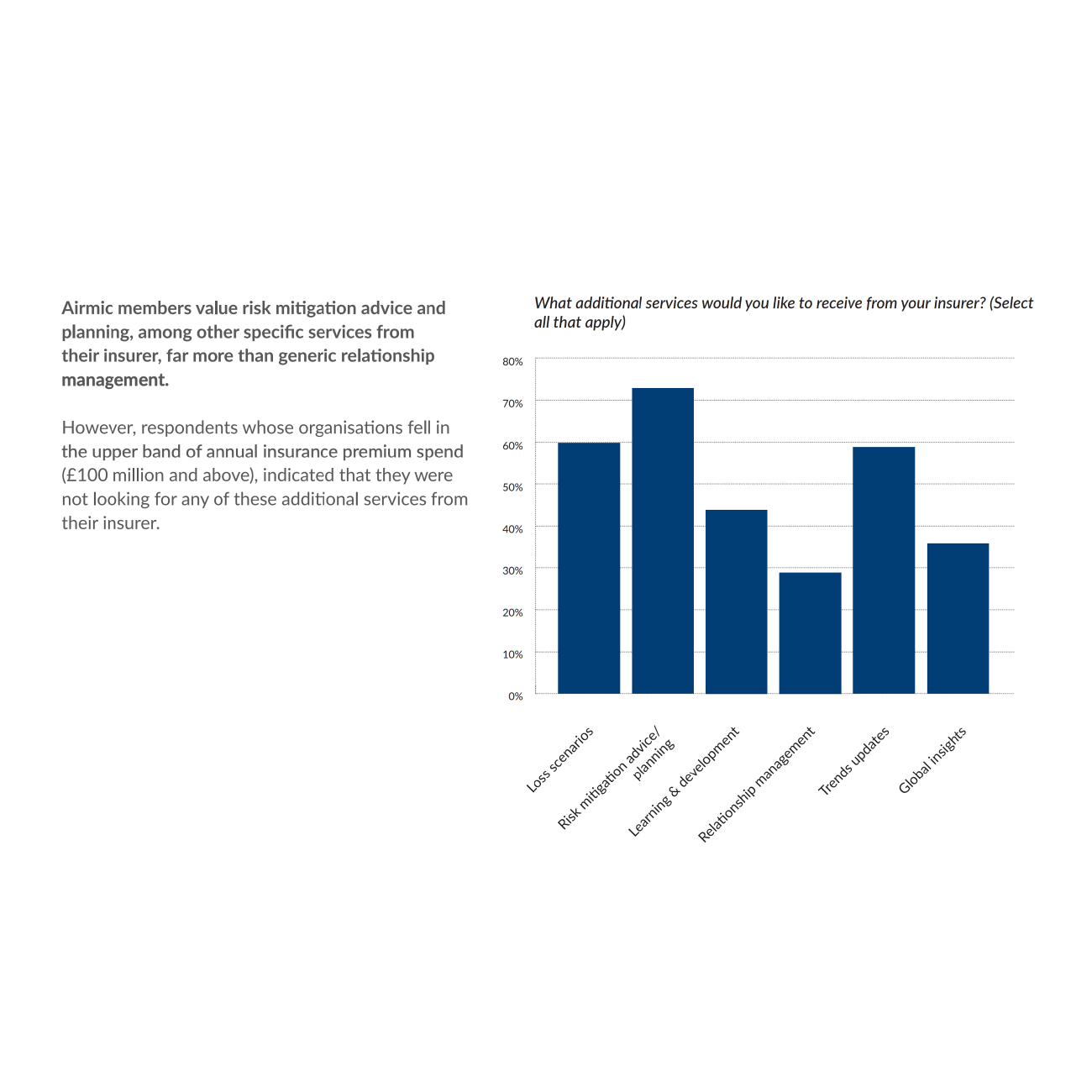

According to a recent AIRMIC survey, nearly three-quarters of respondents are not prepared to challenge claims decisions made by artificial intelligence (AI):

- to be able to understand the ethics and compliance of the use of AI and ideally follow the recently launched AI Code of Conduct

- to be proficient in the use of digital tools and new data sources like Internet of Things (IoT) real-time data insights via sensors

… as well as the human skills such as:

- Identifying solutions that balance insured needs with policy terms and business strategy beyond what AI algorithms might suggest.

- Human judgment and experience supported by AI which are critical in making final decisions, especially for complex or borderline claims where the claims handler needs far more of nuanced understanding of a situation.

- To be resilient and continuously adaptable to change as AI, regulation and insured expectations continue to move apace.

Claims handlers of the future will need to be as comfortable managing data and technology tools as they are managing relationships as well as gaining all these skills in a hybrid working environment.